Uber eats taxes calculator

Enter your VAT number. Lets start with the in-app price estimator.

How Do Food Delivery Couriers Pay Taxes Get It Back

You can find your rate online or just leave it blank with the understanding the the final numbers are underestimates.

. This method allows you to claim a maximum of 5000km at a set rate so your total deduction is quite limited. Enter Your State Tax Rate Here. Ad Uber Eats is the easy way to order the food you love.

Start with 15 since your Self-Employment tax is there. The Uber Eats tax calculator the last. Nightfall mica lexus x fossil teeth for sale.

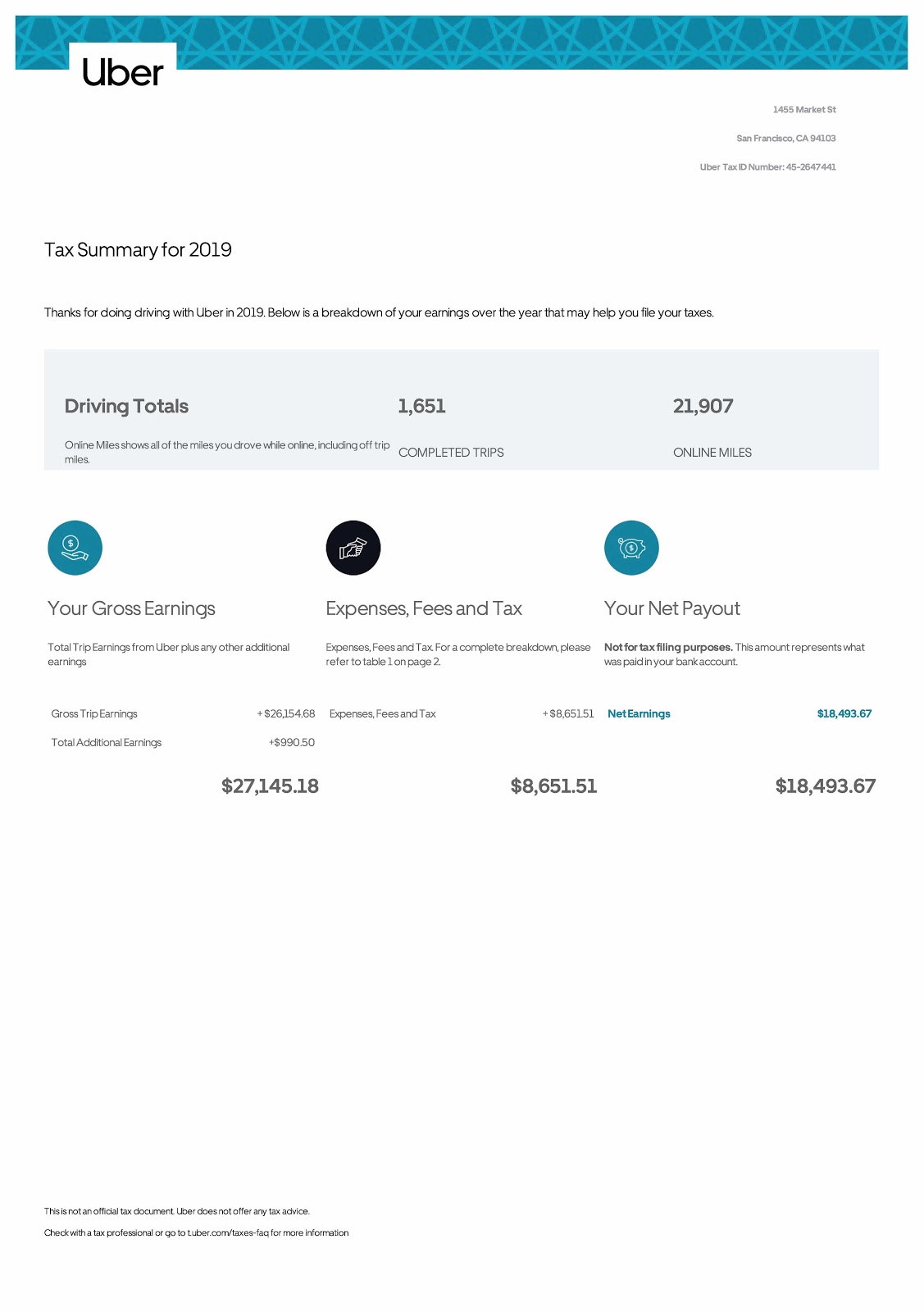

I personally set aside 20 but you can read more about how to save for taxes here. You earned more than 20000 in customer payments in the last year and You provided at least 200 rides or deliveries in the last year You had backup. As a general rule of thumb if you earned over 600 from rideshare driving with Uber or delivery driving with Uber youll have to pay taxes on your income for the year.

Using our Uber driver tax calculator is easy. This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. Currently covering 50 of the US population it is set to cover more than 70 by the end of 2019.

The Platinum Card from American Express offers up to 200 in Uber Cash credits each year. There are two taxes that youll likely be charged. Net Revenue for Uber Eats 55 35 12 8.

There are three reliable Uber fare calculator options within the Uber app on the Uber website or with Ridesters Uber fare estimator. All you need is the following information. Female millionaires network marketing.

Find what youre craving place your order and track your food in the app. Cardholders receive up to 15 in Uber Cash per month with an additional 20 total 35 in. The Future of Uber Eats.

The rate is 72 cents per km so your. Add your VAT number to your Uber profile by following these steps. Well send you a 1099-K if.

The average number of hours you drive per week Your average number of rides. Here are the rates. Uber Eats Tax Return starts from 120 3 Uber with other Income such as Salary and Wages 180 4 We charge extra 50 for each rental property you.

Uber Tax Return starts from 150 2.

Uber Vat Compliance For Belgian Uber Eats Delivery Partners

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How To File Your Uber Driver Tax With Or Without 1099

How To File Your Uber Driver Tax With Or Without 1099

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

Does Uber Track Your Miles

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How Do Food Delivery Couriers Pay Taxes Get It Back

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

How To Do Your Taxes For Uber Eats Partners In Australia Youtube

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

How Do Food Delivery Couriers Pay Taxes Get It Back

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience